ROYAL ENFIELD Sales October 2024 - Classic 350 Tops the Sales Chart

Ishita Sharma 2024-11-09

Ishita Sharma 2024-11-09

Royal Enfield continues its strong performance in the Indian and international motorcycle markets, as well as maintaining its position as one of the dominant players in the mid-size motorcycle segment. While the specific November 2024 sales report might not be fully available yet (since the month's data is still being compiled), you can get here the general overview of Royal Enfield's sales trending over the past few months.

Royal Enfield Sales Trends (August - October 2024)

Royal Enfield has been consistently leading the middleweight motorcycle segment in India, especially in the 350cc to 650cc range, with models like the Classic 350, Hunter 350, and the Meteor 350 continuing to perform well.

Global Expansion: Besides strong sales in India, Royal Enfield has been steadily increasing its presence in international markets, particularly in Europe, North America, and Southeast Asia, where it is appealing to both retro and modern-classic motorcycle enthusiasts.

ROYAL ENFIELD Sales October 2024 vs. October 2023

|

Month |

Sales Units |

Market Share (%) |

Year-on-Year Change in Sales |

Explanation |

|

October 2024 |

95,113 |

4.61% |

+25,240 |

A substantial increase in sales compared to Oct 2023, reflecting strong demand in both domestic and international markets. The 4.61% market share indicates consistent performance in the mid-size motorcycle segment. |

|

October 2023 |

69,873 |

4.61% |

N/A |

The previous year’s figure, which set the benchmark for performance. The market share remained steady at 4.61%, but sales were relatively lower compared to October 2024. |

|

Year-on-Year Change |

+25,240 units |

N/A |

+36.2% |

The year-on-year growth in sales is approximately 36.2%, showcasing a remarkable sales surge, likely driven by successful model launches, festive season demand, and expansion in international markets. |

ROYAL ENFIELD Sales October 2024 - Key Insights and Explanation

Sales Units: October 2024 saw 95,113 units sold, a significant increase of 25,240 units over October 2023. This jump of ~36.2% in sales points to a strong upward trend for Royal Enfield, reflecting not only higher domestic demand but also continued growth in exports.

Market Share: Despite the increase in sales, the market share (%) remained consistent at 4.61% in both October 2024 and October 2023. This consistency could indicate that while Royal Enfield’s absolute sales have grown, the overall market for motorcycles might have also expanded, which kept the brand’s relative market share stable. However, it still reflects Royal Enfield’s dominant position in the mid-size motorcycle segment (350cc to 650cc).

Year-on-Year Growth: The +36.2% increase in sales represents strong performance in October 2024 compared to October 2023. This growth could be attributed to:

- New model launches (like the Hunter 350, updates to the Classic 350, or 650 Twins).

- Increased demand during the festive season (which typically boosts motorcycle sales in India).

- Improved export performance, with Royal Enfield expanding its footprint in international markets.

Festive Season Impact: The October 2024 figures likely benefited from the Diwali season and the accompanying festive demand for motorcycles in India, where consumers traditionally make big-ticket purchases. This period typically sees a surge in sales, especially for established brands like Royal Enfield.

Domestic vs. Export Markets: Royal Enfield's domestic sales have been strong, but it’s the export markets that likely played a significant role in driving the year-over-year sales boost. International markets, including Europe, North America, and Southeast Asia, have become increasingly important for Royal Enfield, with demand for its retro-style motorcycles continuing to grow.

Long-term Trends: If the growth trend continues, Royal Enfield could further increase its market share in the mid-size segment, especially if it introduces new variants, focuses on electric mobility, and capitalizes on its established global appeal.

ROYAL ENFIELD November 2024 Sales Report Overview (Past Few Months)

|

August 2024: Royal Enfield sold around 70,000-75,000 units in India, showing consistent growth in comparison to previous months. Exports also remained strong, with international markets contributing to the overall sales volume. |

September 2024: Sales were slightly higher, with estimates of around 75,000-80,000 units in India. The Classic 350 and Hunter 350 were the top sellers during this period, with the Interceptor 650 continuing to perform well in premium markets. |

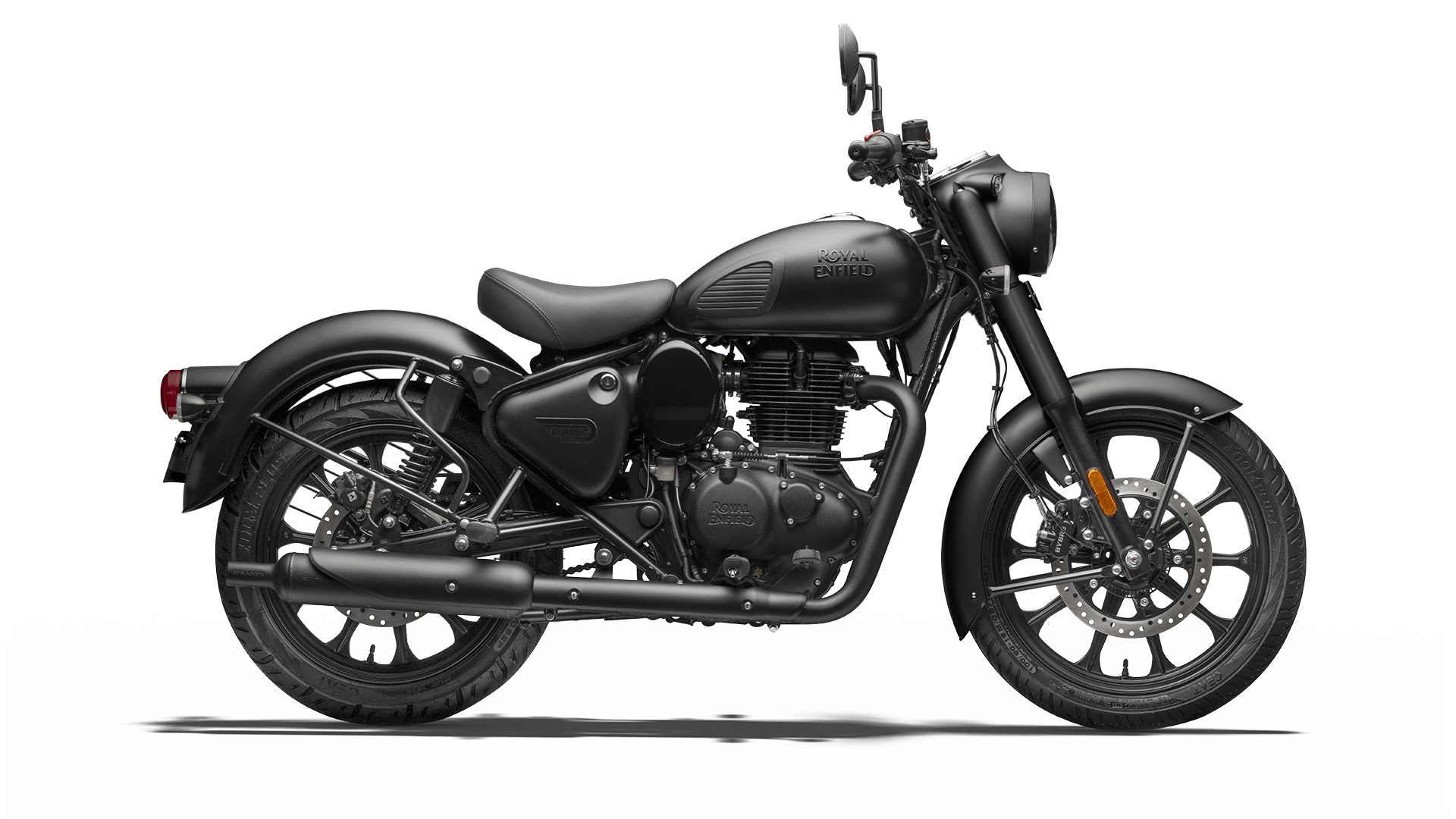

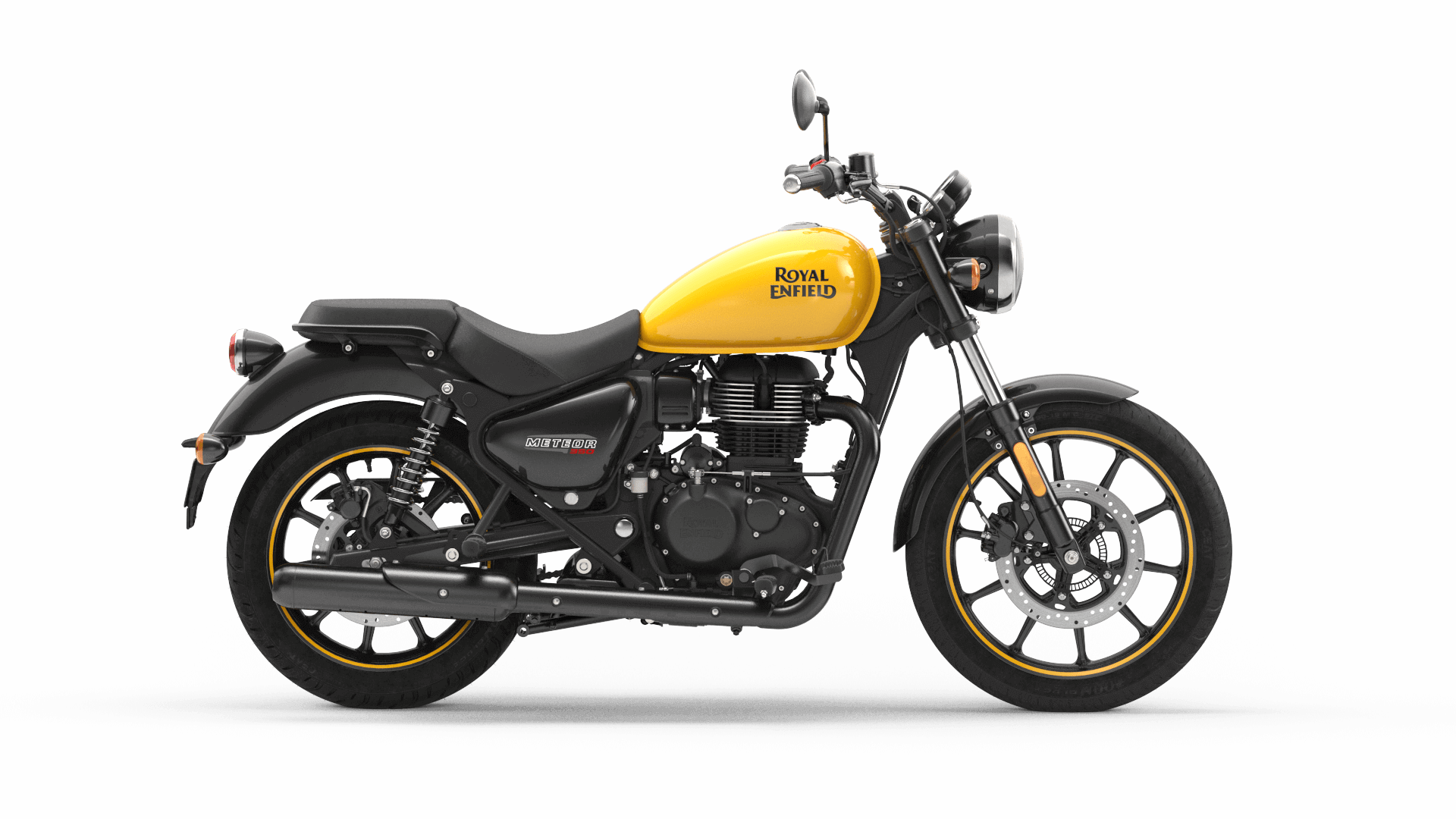

October 2024: As the festival season began, Royal Enfield likely saw a spike in demand, with 85,000+ units sold in India. The Classic 350 was again the top seller, followed by the Meteor 350 and Hunter 350. The company also offered special festive discounts and launched new color variants for popular models, further boosting sales. |

Popular Models in 2024

- Classic 350: The Classic 350 remains one of Royal Enfield’s most popular models, accounting for a significant portion of the company's total sales. Its combination of retro design, comfort, and reliability has made it a favorite among both new and seasoned riders.

- Meteor 350: The Meteor 350 continues to be a strong performer, with its cruiser appeal and features like the Tripper Navigation system and modern aesthetics, appealing to a wide range of riders.

- Hunter 350: The Hunter 350 was introduced as a more urban-oriented option, offering a slightly smaller and lighter footprint while retaining the classic charm that Royal Enfield is known for. Its affordable price point has made it a hit among younger riders and commuters.

The Royal Enfield 650 Twins (Interceptor 650 & Continental GT 650)

- The Interceptor 650 and Continental GT 650 have remained key contributors to Royal Enfield’s performance in the premium segment, with both models continuing to attract enthusiasts looking for an entry-level twin-cylinder motorcycle.

- With growing interest in international markets, particularly in Europe and North America, these models are expected to maintain steady sales.

Royal Enfield's Push into Electric Motorcycles

- Electric Motorcycle Development: Royal Enfield is also working on expanding its portfolio of electric motorcycles, with an emphasis on building retro-inspired electric models. This could be a key factor in driving future sales, as demand for electric motorcycles grows.

- The company’s push into e-mobility is expected to take shape in the coming years, with potential launches expected post-2024.

November 2024 Sales Expectations

Festive Season Boost: October-November is traditionally one of the best sales periods for motorcycle manufacturers in India, as Diwali and other festivals drive demand for vehicles. The ongoing festival season could lead to an uptick in Royal Enfield’s sales, particularly with promotions, discounts, and new special edition models launched around this time.

Royal Enfield could see increased interest in their 350cc and 650cc models, as these are ideal for both city commuting and long-distance touring, making them popular choices for riders during the holidays.

New Product Launches: Royal Enfield has been known to launch new variants and special edition models during this period. In November 2024, the company may have launched limited-edition variants of its popular models like the Classic 350, Meteor 350, and Interceptor 650, which could boost sales further.

Partnerships and Collaborations: The company’s collaborations, such as with Motorrad, accessory brands, or even influencers, might play a role in building awareness and increasing sales.

International Markets: In global markets, particularly in Europe and North America, Royal Enfield could see steady growth, driven by the interest in retro-style motorcycles that are easier to maintain and offer a unique riding experience. With dealership expansions and increasing brand recognition, these markets are likely to remain strong for Royal Enfield.

Royal Enfield’s Strategy for November 2024 and Beyond

Product Portfolio: Royal Enfield is expected to continue focusing on the 350cc segment, which has been a major contributor to their success in India. Models like the Classic 350 and Meteor 350 are likely to continue driving volumes.

- For the 650cc segment, the Interceptor 650 and Continental GT 650 will continue to target riders looking for more power and refinement. Royal Enfield may also update these models in the near future to keep them competitive in the evolving market.

Focus on Emerging Markets: Southeast Asia, Latin America, and Africa remain key growth regions for Royal Enfield. The company’s expansion into new markets, combined with the rising demand for middleweight motorcycles, could drive further sales in these regions.

Electric Motorcycles: Royal Enfield's foray into the electric motorcycle market is still in the early stages, but expect the brand to unveil an electric model in the coming years to complement its existing lineup.

ROYAL ENFIELD Sales November 2024 Report is expected to remain strong due to the festive season demand and the continuing popularity of its 350cc and 650cc models. While the exact figures for November are not yet available, the company’s consistent performance and strategic launches during key periods like Diwali suggest that Royal Enfield will likely achieve solid sales figures this month. The upcoming months could also see the brand continue to capitalize on its legacy in the mid-size segment and its expansion into electric mobility.

.jpg)

.jpg)